- SUCCESS! CONGRATS ON RECEIVING YOUR FREE TIPS.

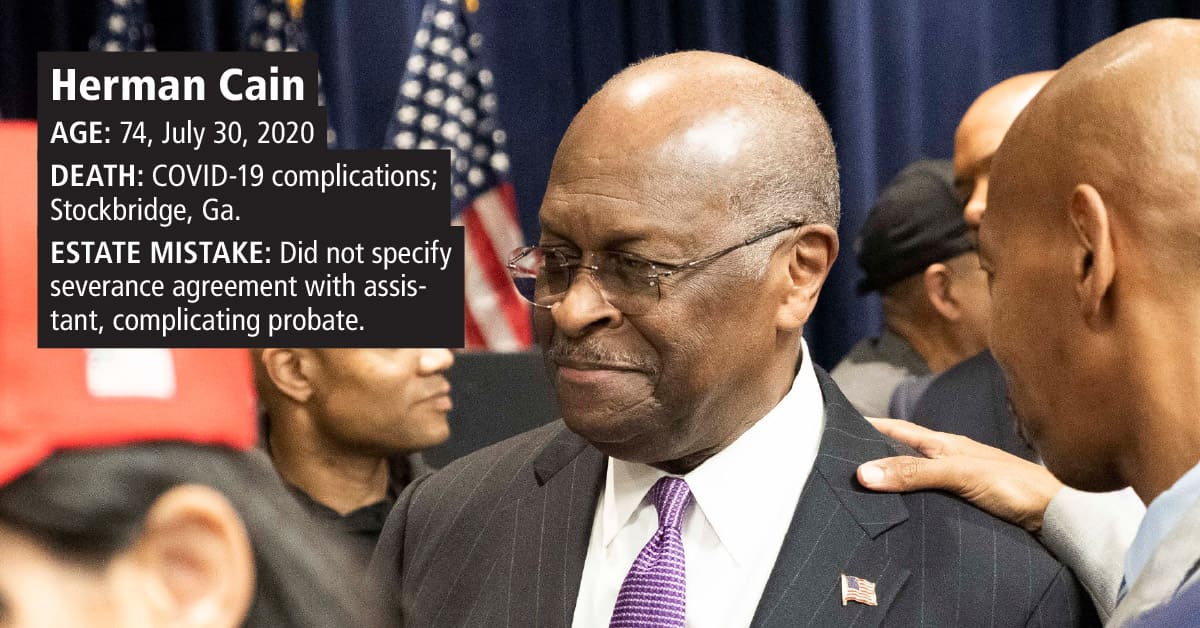

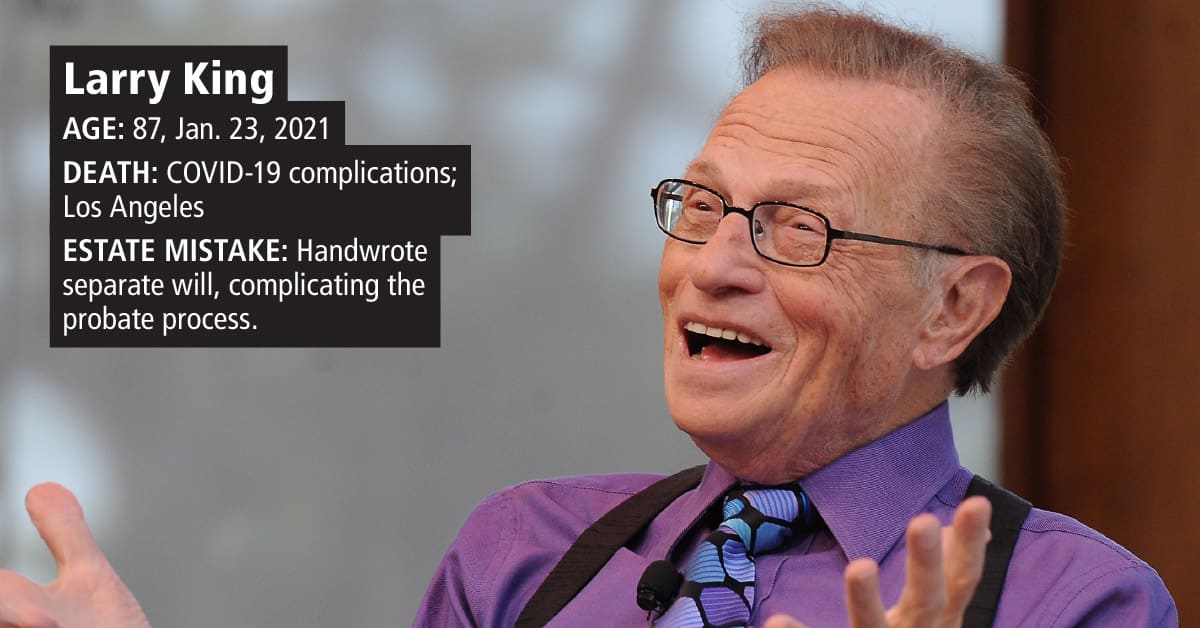

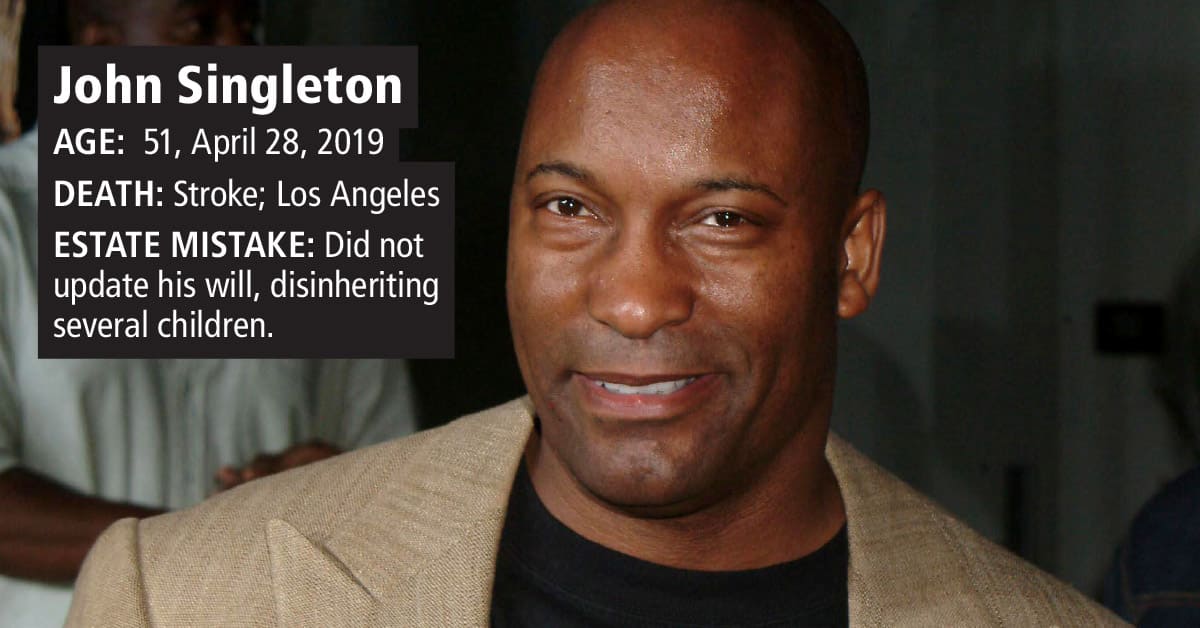

Even celebrities can make mistakes with their Estate Planning

Despite their fame and fortune, many high-profile individuals have made costly mistakes when it comes to planning for the future. From Prince to Aretha Franklin, there are numerous examples of celebrities who failed to properly plan their estates, leading to lengthy legal battles and millions of dollars lost.

Don't let this happen to you! Book a free consultation with an experienced estate planning attorney to build your estate plan.

REWARDS & RECOGNITIONS

REWARDS & RECOGNITIONS

Here’s A brief outline of what we'll cover in your free strategy session

How to avoid probate

We'll show you how to avoid the time-consuming and costly probate process. We will unveil the effective methods to bypass probate and ensure a smoother transition of your assets to your heirs.

How to plan your health care

In the event of incapacitation, it's important to have a plan for your medical care. We'll help you set up a healthcare power of attorney and living will to ensure your wishes are carried out.

Secure your children's future

Discuss how to provide for your children and their future with a comprehensive estate plan. We'll cover guardianship, education funds, and trusts to protect their inheritance.

Avoid family disputes

A well-crafted estate plan can help avoid disputes among family members after your passing. We'll discuss how to minimize conflict and ensure your wishes are respected.

Plan for long-term care

We'll help you plan for potential long-term care needs and discuss options such as long-term care insurance and Medicaid planning.

And much, much more!

REWARDS & RECOGNITIONS

REWARDS & RECOGNITIONS

here are the top 3 most common estate planning mistakes

While you might assume estate planning only applies to wealthy people, that’s not the case. An estate only refers to what you own: financial accounts, real estate and possessions. Putting a plan in place for those assets helps ensure that upon your death, your wishes are carried out and that family squabbles don’t evolve into destroyed relationships. In other words, it’s partly about making things easier for your loved ones during an already-difficult time.

Naming just one beneficiary

You should always have more than one beneficiary designated for any of your assets. In the event that a beneficiary passes away before you do, you’ll want to have what’s known as a contingent beneficiary.

Forgetting about final arrangements

Your loved ones will be grieving after you pass away, but planning in advance what you’d like to have happen (in terms of your funeral or burial arrangements) can be a blessing for those you leave behind.

Forgetting about charities that are important to you

Particularly if you have a large estate, but even if you don’t have incredible wealth, you can still allocate some of your assets to benefit a charity that’s important to you.